Well, with the General Election just over the horizon and

having been asked by a number of Warrington homeowners and Warrington buy to

let landlords what the different main parties would do to the Warrington

property market, in this week’s article we focus on the Conservative Party policy.

In 1979, Margaret Thatcher was

voted in on a Tory landslide with the ‘right to buy your own council house’

being a mainstay of Conservative policy. She encouraged people to buy their own

their own council flats and houses, although it might interest you to know, that

the council tenant right to buy idea was first proposed in the late 1950s and

formed part of the manifesto of the Labour party. Yet Maggie’s version was

based on massive discounts for tenants and 100% mortgages (i.e. no deposit). However,

the real bugbear was that half the monies raised form the house sales went to

central Government and the other half to the local authorities … but that money

had to be used to reduce the local authorities debt rather than building new

houses - so houses were being sold and not replaced.

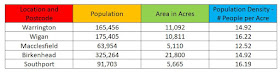

2,466 council homes in the Warrington area have

been

bought in the last 40 years (an average 62 per

year)

Interestingly, the Tories relaxed

the rules in 2012 for right to buy and raised the highest discount on a

property to £75,000 (it has subsequently increased further, to £100,000, in

some parts of the UK) meaning 62,114 council houses have been

sold nationally since the rule change, raising £6.228bn since 2012 alone.

The issue, stated by many existing

council house tenants, is that those tenants turned homeowners subsequently

sell on their ex-council homes at a huge a huge profit, meaning the

demographics of those areas has become ever more transient, more specifically, properties

that were once council homes are now owned by buy-to-let landlords who rent

them out on a short-term basis.

Yet up to this point in time,

nothing has been said

about ‘other’ type of social housing - housing association properties. Whilst

council houses are properties owned by the local authority providing low cost

social housing, housing associations also provide lower-cost social housing for people in need of a

home, yet they are private, non-profit making organisations.

The Tory’s state one of the

biggest divides in our British society is between those who can and cannot

afford their own home, so plan to establish a new national model for shared

ownership which allows people in new housing association properties to buy a

proportion of their home while paying a lower/subsidised rent on the remain

part - helping thousands of lower income earners get a step onto the housing

ladder.

So, what for the tenants of the existing 6,729 housing association

households in Warrington? The Conservatives have said they will work with housing associations on a

voluntary basis to determine what right to buy offer could be made to those Warrington

tenants, although there are already existing rules which give most housing association

tenants the right to buy their home, yet with only modest discounts of

£9,000 to £16,000 depending on where you live. So,

what does all this mean for the current homeowners and landlords of Warrington

properties?

The Tory’s sold off 328 council houses in Warrington

whilst in power between 1979 and 1997

The sales

really created waves in the housing market in the 1980’s and was a contributary

factor to the housing crash of 1987 when Dual-MIRAS tax relief was removed by

Nigel Lawson. By the selling off of council housing in those years they were

accused of selling off the family silver cheaply, thus created the foundation of the buy-to-let boom of the early to mid 2000’s, because of major

shortage of affordable housing being sold in the previous two decades.

Yet this time round, note the

Tory’s state it is just for new housing association properties, not existing.

Also, that tenants will have the right to go into shared ownership - NOT

OUTRIGHT OWNERSHIP. This means this policy will have hardly any effect … unlike

the Thatcher policies of 1979.

If you missed my breakdown on

Labour’s Party policy and what difference that will make to our Warrington

Property Market then you can see that by clicking the link below

https://warringtonproperty.blogspot.com/2019/11/labour-partys-u-turn-on-363665300-grab.html

https://warringtonproperty.blogspot.com/2019/11/labour-partys-u-turn-on-363665300-grab.html

If you are looking for an agent that is well established, professional and communicative, whether you’re buying, selling or looking for an investment opportunity, then contact us to find out how we can get the best out of the Warrington property market.

Email me on manoj@hamletwarrington.co.uk or call on 01925 235 338 – we are based on the Warrington Business Park, Long Lane, WA2 8TX. There is plenty of free parking and the kettle is always on.

Don't forget to visit the links below to view back dated deals and Warrington Property News.

CLICK HERE TO FIND OUT HOW MUCH YOUR WARRINGTON HOME IS WORTH FOR FREE

Hamlet Homes Warrington, your local Estate Agent

Follow my Warrington Property Market Blog

Hamlet Homes Warrington LinkedIn Page

Hamlet Homes Estate Agents Warrington Facebook Page

Hamlet Homes Estate Agents Warrington Twitter Page