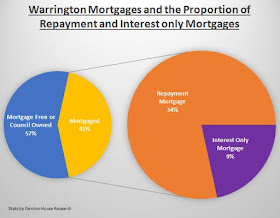

According to my research, of the 70,510

properties in Warrington, 30,433 of

those properties have mortgages on them. 91.1% of those mortgaged properties

are made up of owner-occupiers and the rest are buy-to-let landlords (with a

mortgage).

But this is the concerning part. 6,574 of those Warrington mortgages are interest only.

Each year between 2017 and 2022, 79 of those

households with interest only mortgages will mature, and of those, 20

households a year will either have a shortfall or no way

of paying the mortgage off. Now that might not sound a lot – but it is still

someone’s home that is potentially at risk.

Theoretically this is an enormous problem for

anyone in this situation as their home is at risk of repossession if they don’t

have some means to repay these mortgages at the end of the term, with the

typical term being 25 to 35 years.

Banks and Building Societies are under no obligation to lengthen the term of

the mortgage and, when deciding whether they are prepared to do so or not, will

look at it in the same way as someone coming to them for a new mortgage.

Endowment Mortgages

Back in the 1970s and 1980s, when endowment

mortgages were all the rage, having an endowment meant you were taking out an

interest only mortgage and then paying into an endowment policy which would pay

the mortgage off (plus hopefully leave some profit) at the end of the

25/35-year term. There were advantages to that type of mortgage as the monthly repayments

were lower than with a traditional capital repayment and interest mortgage.

Only the interest, rather than any capital, is paid to the mortgage company -

but the full debt must be cleared at the end of the 25/35-year term.

Historically plenty of Warrington homeowners

bought an endowment policy to run alongside their interest only mortgage.

However, because the endowment policy was a stock market linked investment plan

and the stock market poorly performed between 1999 and 2003 (when the FTSE dropped

49.72%), the endowments of many of these homeowners didn’t cover the shortfall.

Indeed, it left them significantly in

debt!

Nonetheless, in the mid 2000s, when the word

endowment had become a dirty word, the banks still sold ‘interest only’

mortgages. However, this time with no savings plan, endowment or investment

product to pay the mortgage off at the end of the term. It was a case of ‘we’ll

sort that nearer the time’ as property prices were on the rampage in an upwards

direction!

Thankfully, the proportion of interest only

mortgages sold started to decline after the Credit Crunch, as you can see

looking at the graph below, from a peak of 43.81% of all mortgages to the

current 8.71%.

The Future of Mortgaged Properties

Increasing the length of the mortgage to

obtain more time to raise the money has gradually become more difficult since

the introduction of stricter lending criteria in 2014, with many mature

borrowers considered too old for a mortgage extension.

Warrington people who took out interest only

mortgages years ago and don’t have a strategy to pay back the mortgage face a

ticking time bomb. It would either be a choice of hastily scraping the money

together to pay off their mortgage, selling their property, or the possibility

of repossession (which to be frank, is a disturbing prospect).

I want to stress to all existing and future homeowners who use

mortgages to go in to them with your

eyes open.

You must understand, whilst the banks and

building societies could do more to help, you too have personal responsibility

in understanding what you are signing yourself up to. It’s not just the monthly

repayments, but the whole picture in the short and long term.

Many of you reading my blog ask why I say

these things. I want to share my thoughts and opinions on the real issues

affecting the Warrington property market, warts and all. If you want fluffy

clouds and rose tinted glasses articles – then my articles are not for you.

However, if you want someone to tell you the real story about the Warrington

property market, be it good, bad or indifferent, then maybe you should start

reading my blog regularly.

You can always keep an eye on my blog for any properties I feel

will make a good buy to let opportunity, or if you are after a second opinion

then email me on manoj@hamletwarrington.co.uk or call on 01925

235338. If you are in the area, feel free to pop into the office – we are based

on 6 Bankside, Crosfield St, WA1 1UP. There is plenty of free parking

and the kettle is always on.

Don't forget

to visit the links below to view back dated deals and Warrington Property News.

Follow

The Buy-To-Let Property Investment Market in Warrington

Warrington Property Market LinkedIn Page

Hamlet Homes Letting Agents Warrington Facebook Page

Hamlet Homes Letting Agents Warrington Twitter Page

Warrington Investment Property Specialist Hamlet Homes Website

Warrington Property Market LinkedIn Page

Hamlet Homes Letting Agents Warrington Facebook Page

Hamlet Homes Letting Agents Warrington Twitter Page

Warrington Investment Property Specialist Hamlet Homes Website

No comments:

Post a Comment