The mind-set and tactics you employ to buy your first Warrington

buy to let property needs to be different to the tactics and methodology of

buying a home for yourself to live in. The main difference is when purchasing

your own property, you may well pay a little more to get the home you (and your

family) want, and are less likely to compromise. When buying for your own use,

it is only human nature you will want the best, so that quite often it is at

the top end of your budget (because as my

parents always used to tell me – you get what you pay for in this world!).

Yet with a buy to let property, if your goal is a higher

rental return – a higher price doesn’t always equate to higher monthly returns

– in fact quite the opposite. Inexpensive Warrington properties can bring in

bigger monthly returns. Most landlords use the phrase ‘yield’ instead of

monthly return. To calculate the yield on a buy to let property one basically takes

the monthly rent, multiplies it by 12 to get the annual rent and then divides

it by the value of the property.

This means, if one increases the value of the property using

this calculation, the subsequent yield drops. Or to put it another way, if a Warrington

buy to let landlord has the decision of two properties that create the same amount

of monthly rent, the landlord can increase their rental yield by selecting the lower

priced property.

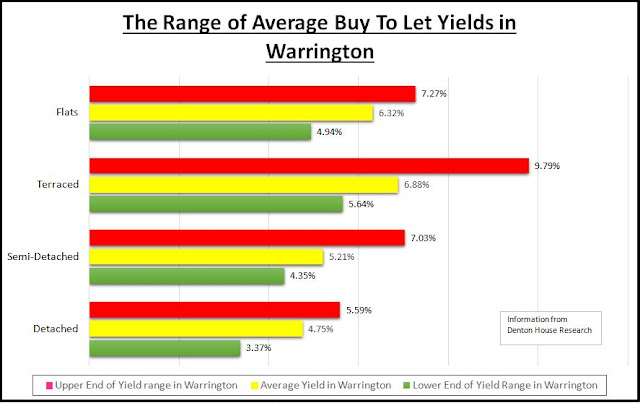

To give you an idea of the sort of returns in Warrington...

Warrington

Property type

|

Average

Price paid (last 12 months) in Warrington

|

Average

Rent Achieved in last 12 months in Warrington

|

Lower

End of Yield Range in Warrington

|

Average Yield in Warrington

|

Upper

End of Yield range in Warrington

|

Detached

|

£301,726

|

£1,195

|

3.37%

|

4.75%

|

5.59%

|

Semi-Detached

|

£175,668

|

£762

|

4.35%

|

5.21%

|

7.03%

|

Terraced

|

£126,118

|

£723

|

5.64%

|

6.88%

|

9.79%

|

Flats

|

£109,446

|

£576

|

4.94%

|

6.32%

|

7.27%

|

Now of course

these are averages and there will always be properties outside the lower and

upper ranges in yields: they are a fair representation of the gross yields you

can expect in the Warrington area.

As we move forward, with the total amount of buy to let mortgages amounting to £199,310,614,000 in the country, landlords need to be aware of the investment performance of their property, especially in the era of tax increases and tax relief reductions. Landlords are looking to maximise their yield - and are doing so by buying cheaper properties.

However, before everyone in Warrington starts selling their

upmarket properties and buying cheap ones, yield isn’t the only factor when

deciding on what Warrington buy to let property to buy. Void periods (i.e. the time when there isn’t

a tenant in the property between tenancies) are an important factor and those

properties at the cheaper end of the rental spectrum can suffer higher void

periods too. Apartments can also have service charges and ground rents that

aren’t accounted for in these gross yields. Landlords can also make money if

the value of the property goes up and for those Warrington landlords who are

looking for capital growth, an altered investment strategy may be required.

In Warrington, for example, over the last 20 years, this is

how the average price paid for the four different types of Warrington property

have changed…

·

Warrington Detached Properties have increased in

value by 230.1%

·

Warrington Semi-Detached Properties have

increased in value by 233.6%

·

Warrington Terraced Properties have increased in

value by 248.7%

·

Warrington Apartments have increased in value by

235.5%

It is very much a balancing act of yield, capital growth and

void periods when buying in Warrington. Every landlord’s investment strategy is

unique to them. If you would like a fresh pair of eyes to look at your

portfolio, be you a private landlord that doesn’t use a letting agent or a

landlord that uses one of my competitors – then feel free to drop in and let’s

have a chat. What have you got to lose? 30 minutes and my tea making skills are

legendary!

You can always keep an eye on my blog for any properties I feel will make a good buy to let opportunity, or if you are after a second opinion then email me on manoj@hamletwarrington.co.uk or call on 01925 235338. If you are in the area, feel free to pop into the office – we are based on 6 Bankside, Crosfield St, WA1 1UP. There is plenty of free parking and the kettle is always on.

Don't forget to visit the links below to view back dated deals and Warrington Property News.